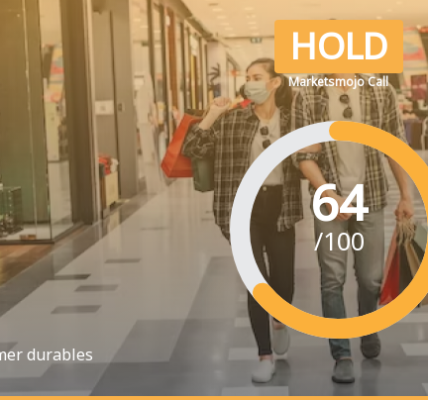

Elin Electronics, a microcap company in the electronics components industry, has recently faced a downgrade in its stock call to ‘Sell’ by MarketsMOJO as of December 30, 2024. This decision stems from concerns regarding the company’s long-term growth, highlighted by an annual operating profit decline of 1.66% over the past five years.

The company’s financial performance showed flat results for September 2024, with operating cash flow at its lowest point of Rs 42.67 crore. Additionally, non-operating income constituted 40.53% of profit before tax, raising further concerns about sustainability. The stock is currently in a mildly bearish range, with a deterioration in technical trends and a return of -3.69% since the downgrade.

Despite these challenges, Elin Electronics demonstrates a strong ability to service its debt, evidenced by a low debt-to-EBITDA ratio of 0.61 times. The company also boasts a return on equity of 3.3 and a price-to-book value of 1.9, indicating an attractive valuation. Over the past year, the stock has outperformed the market with a return of 35.37%, although profits have decreased by 48%. Institutional investors have increased their stake by 1.81%, now holding 14.06% of the company.