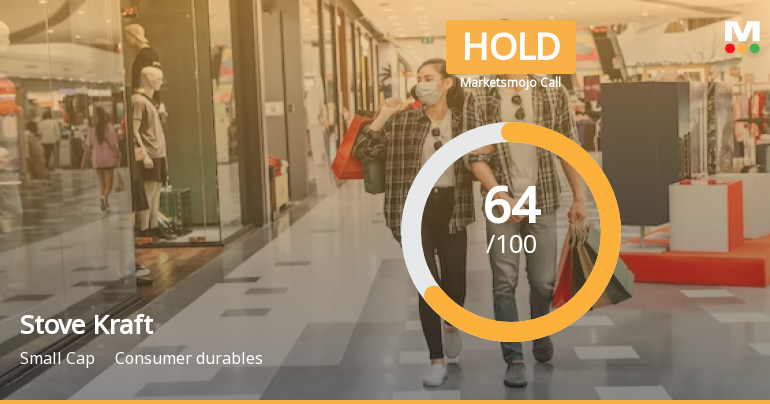

Stove Kraft, a small-cap player in the consumer durables sector, has recently seen its stock call downgraded to ‘Hold’ by MarketsMOJO as of December 23, 2024. This decision comes despite positive results reported for September 2024, where the company achieved its highest operating cash flow at Rs 112.58 crore and a dividend per share of Rs 2.50, reflecting a dividend payout ratio of 24.21%.

Technically, the stock is positioned in a mildly bullish range, supported by indicators such as MACD, Bollinger Bands, and KST. With a return on capital employed (ROCE) of 10.3 and an enterprise value to capital employed ratio of 4.2, Stove Kraft presents an attractive valuation, trading at a discount to its historical averages.

Over the past year, the stock has delivered an impressive return of 84.22%, significantly outperforming the BSE 500 index, which returned 16.96%. However, the company has faced challenges in long-term growth, with operating profit declining at an annual rate of 12.58% over the last five years. Institutional investors have increased their stake by 1.41%, now holding 5.62% of the company.