As global markets navigate a period of monetary policy adjustments and mixed economic signals, investors are keenly observing the potential impacts on various indices. With major stock indexes experiencing fluctuations—such as the Nasdaq reaching new heights while others decline—the search for undervalued stocks becomes particularly pertinent. In such an environment, identifying stocks that are estimated to be below their fair value can offer strategic opportunities for investors looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (NasdaqGS:UMBF) | US$123.38 | US$244.22 | 49.5% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1132.90 | ₹2237.94 | 49.4% |

| Business First Bancshares (NasdaqGS:BFST) | US$27.78 | US$54.95 | 49.4% |

| Absolent Air Care Group (OM:ABSO) | SEK254.00 | SEK506.18 | 49.8% |

| Equity Bancshares (NYSE:EQBK) | US$46.66 | US$92.69 | 49.7% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP291.50 | CLP578.67 | 49.6% |

| BYD Electronic (International) (SEHK:285) | HK$40.30 | HK$79.63 | 49.4% |

| Wetteri Oyj (HLSE:WETTERI) | €0.297 | €0.59 | 49.9% |

| Constellium (NYSE:CSTM) | US$11.01 | US$21.77 | 49.4% |

| Gold Road Resources (ASX:GOR) | A$2.08 | A$4.15 | 49.9% |

Click here to see the full list of 880 stocks from our Undervalued Stocks Based On Cash Flows screener.

Here we highlight a subset of our preferred stocks from the screener.

Overview: BHG Group AB (publ) is a consumer e-commerce company operating in Sweden, Finland, Denmark, Norway, the rest of Europe, and internationally with a market cap of approximately SEK3.71 billion.

Operations: The company’s revenue is primarily derived from its Home Improvement segment at SEK5.16 billion, followed by the Value Home segment at SEK2.52 billion and the Premium Living segment at SEK2.28 billion.

Estimated Discount To Fair Value: 27.4%

BHG Group’s recent financials show a significant reduction in net loss, with the third quarter net loss at SEK 67.2 million compared to a very large loss of SEK 1,308.8 million the previous year. Despite sales and revenue declines, BHG is trading at SEK 20.68, approximately 27.4% below its estimated fair value of SEK 28.5, suggesting undervaluation based on cash flows. The company is expected to become profitable within three years with above-average market growth projections.

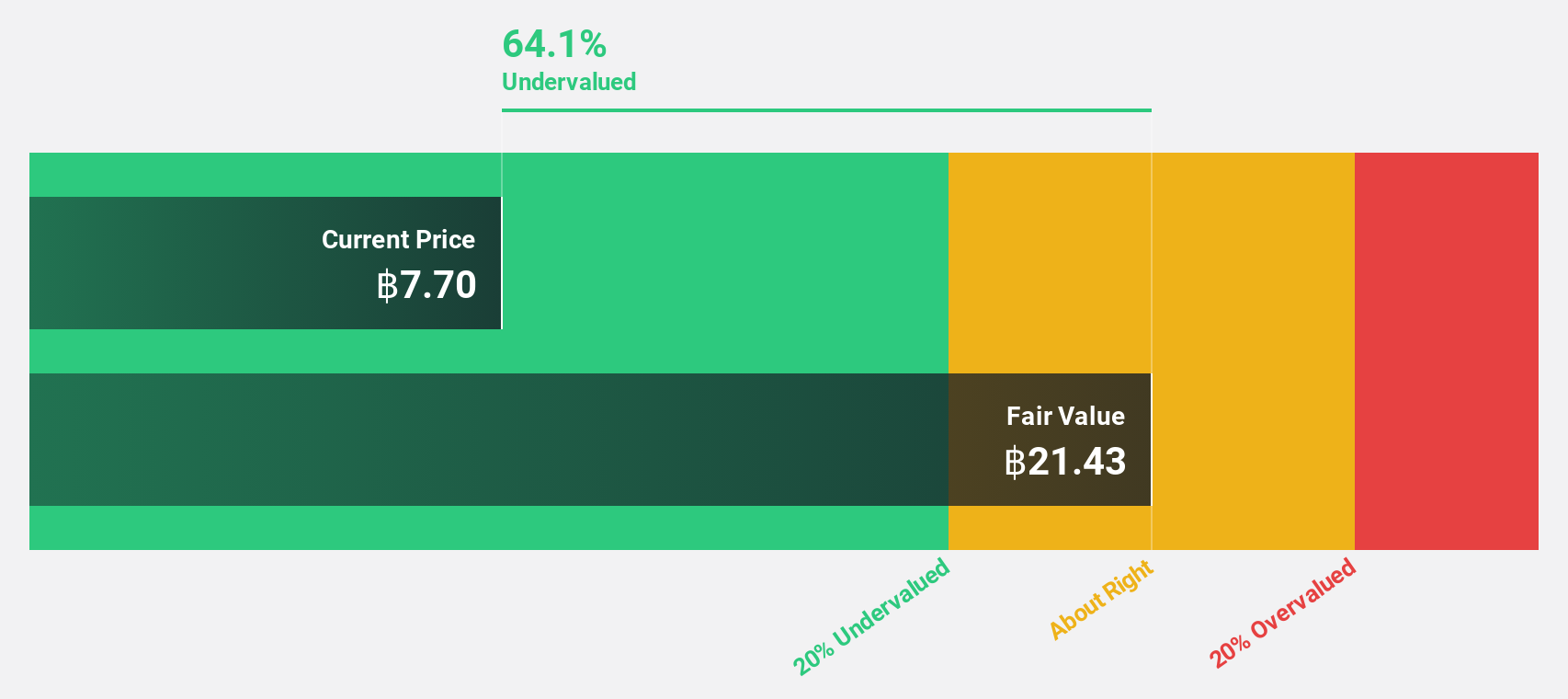

Overview: Thai Coconut Public Company Limited produces and distributes coconut products in Thailand, with a market cap of THB17.64 billion.

Operations: The company generates revenue from coconut milk products amounting to THB2.29 billion and coconut water products totaling THB3.28 billion.

Estimated Discount To Fair Value: 44.4%

Thai Coconut is trading at THB 12, significantly undervalued compared to its estimated fair value of THB 21.59. Recent earnings reports show strong revenue growth, with third-quarter revenue reaching THB 1.93 billion, up from THB 1.30 billion a year prior. However, the dividend yield of 4.17% is not well covered by free cash flows. Earnings are projected to grow annually by over 20%, outpacing the Thai market’s growth expectations and supporting its undervaluation thesis based on cash flows.

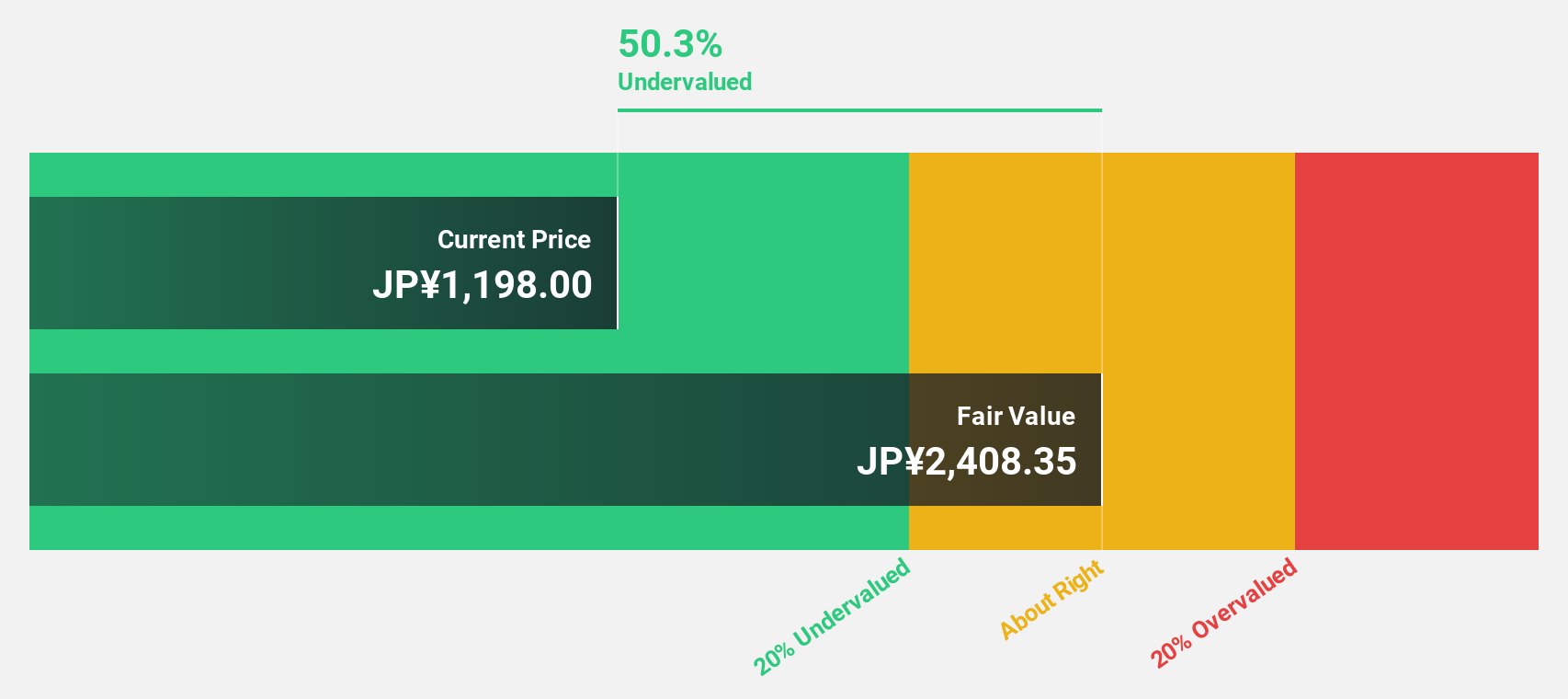

Overview: Forum Engineering Inc. offers personnel management services for mechanical and electrical engineers in Japan, with a market cap of ¥51.45 billion.

Operations: The company generates revenue primarily from its Engineer Dispatch/Recruitment Business, amounting to ¥32.93 billion.

Estimated Discount To Fair Value: 43.4%

Forum Engineering, trading at ¥982, is significantly undervalued compared to its estimated fair value of ¥1735.65. It was recently added to the S&P Global BMI Index and is trading over 20% below its fair value based on discounted cash flow analysis. Despite having less than three years of financial data available, the company’s revenue growth forecast of 9.2% annually surpasses Japan’s market average, while earnings are expected to grow at 11.5% per year.

Key Takeaways

Ready To Venture Into Other Investment Styles?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice.

It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Thai Coconut might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]