As global markets navigate a mixed economic landscape, with U.S. consumer confidence dipping and European growth estimates revised lower, investors are keenly observing the performance of major indices which have shown moderate gains despite these challenges. In such an environment, identifying stocks trading below their intrinsic value can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Lundin Gold (TSX:LUG) | CA$31.92 | CA$63.81 | 50% |

| Tourmaline Oil (TSX:TOU) | CA$67.37 | CA$134.34 | 49.9% |

| Bank BTPN Syariah (IDX:BTPS) | IDR935.00 | IDR1869.73 | 50% |

| Strike CompanyLimited (TSE:6196) | ¥3655.00 | ¥7284.35 | 49.8% |

| Camden National (NasdaqGS:CAC) | US$42.25 | US$84.44 | 50% |

| S Foods (TSE:2292) | ¥2737.00 | ¥5472.35 | 50% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.76 | €5.50 | 49.8% |

| Elekta (OM:EKTA B) | SEK61.80 | SEK123.12 | 49.8% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| Vogo (ENXTPA:ALVGO) | €2.95 | €5.87 | 49.8% |

Click here to see the full list of 897 stocks from our Undervalued Stocks Based On Cash Flows screener.

We’ll examine a selection from our screener results.

Overview: Advanced Nano Products Co., Ltd. manufactures and sells high-tech materials, including displays, semiconductors, secondary batteries, and solar cells in South Korea and internationally, with a market cap of ₩695.14 billion.

Operations: The company generates revenue primarily from its Specialty Chemicals segment, amounting to ₩86.63 billion.

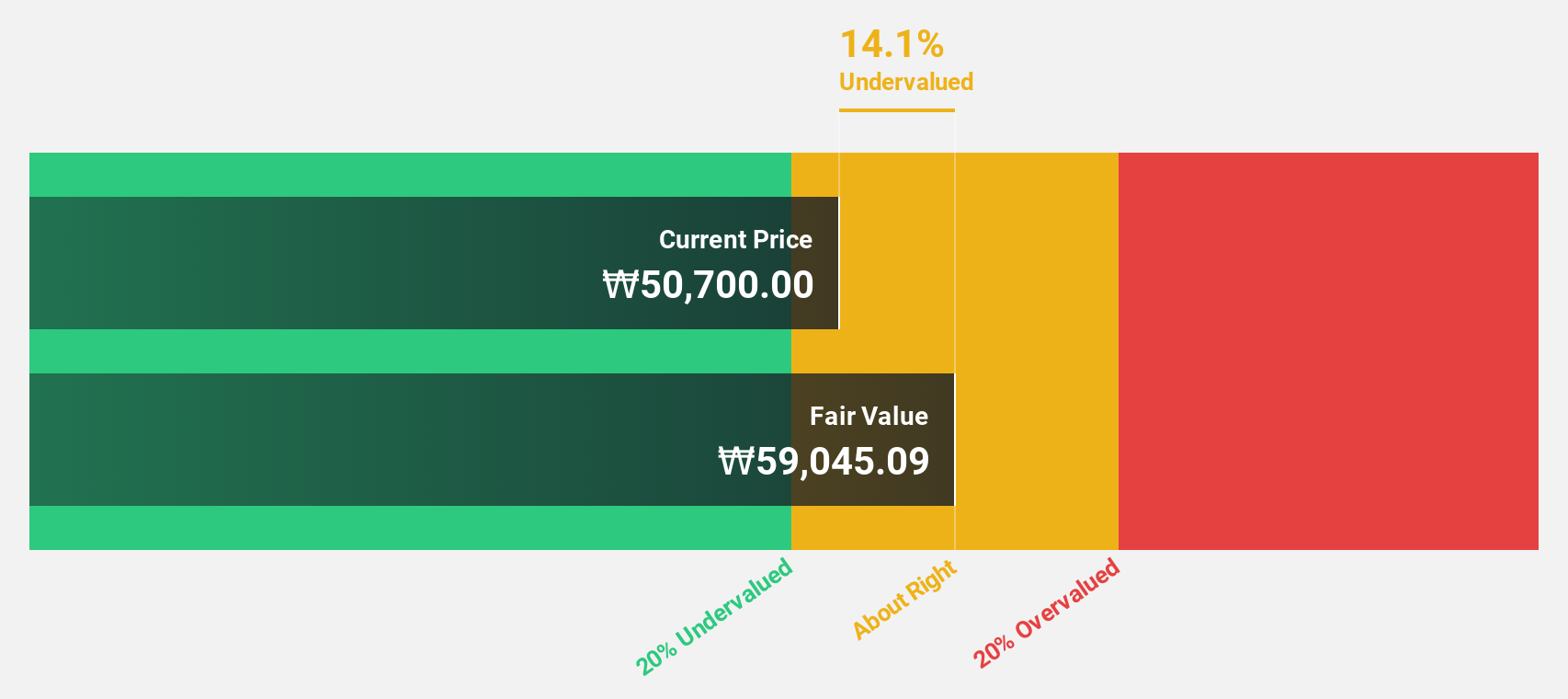

Estimated Discount To Fair Value: 15.5%

Advanced Nano Products is trading at ₩61,400, below its estimated fair value of ₩72,698.71. Despite recent declines in profit margins and earnings per share compared to last year, the company’s revenue is forecast to grow significantly at 45% annually, outpacing the KR market’s 9% growth rate. Earnings are also expected to rise substantially by 70% per year over the next three years. However, current net income has decreased from last year’s figures.

Overview: Hotel Shilla Co., Ltd is a hospitality company operating in South Korea and internationally, with a market cap of ₩1.38 trillion.

Operations: The company’s revenue is primarily derived from its Travel Retail segment, which generated ₩3.30 trillion, and its Hotel & Leisure Sector, contributing ₩707.79 billion.

Estimated Discount To Fair Value: 44.2%

Hotel Shilla Ltd. is trading at ₩36,650, significantly below its estimated fair value of ₩68,485.64, suggesting it may be undervalued based on cash flows. The company’s earnings are projected to grow 118.11% annually over the next three years, surpassing average market growth expectations and becoming profitable within this period. However, interest payments remain inadequately covered by earnings despite revenue forecasts of 9.6% annual growth outpacing the Korean market’s 8.9%.

Overview: Taiwan Union Technology Corporation manufactures and sells copper foil substrates, adhesive sheets, and multi-layer laminated boards in Taiwan and internationally, with a market cap of NT$47.20 billion.

Operations: The company generates revenue from its Foreign Sales and Manufacturing Sector amounting to NT$13.22 billion and its Domestic Sales and Manufacturing Sector totaling NT$7.95 billion.

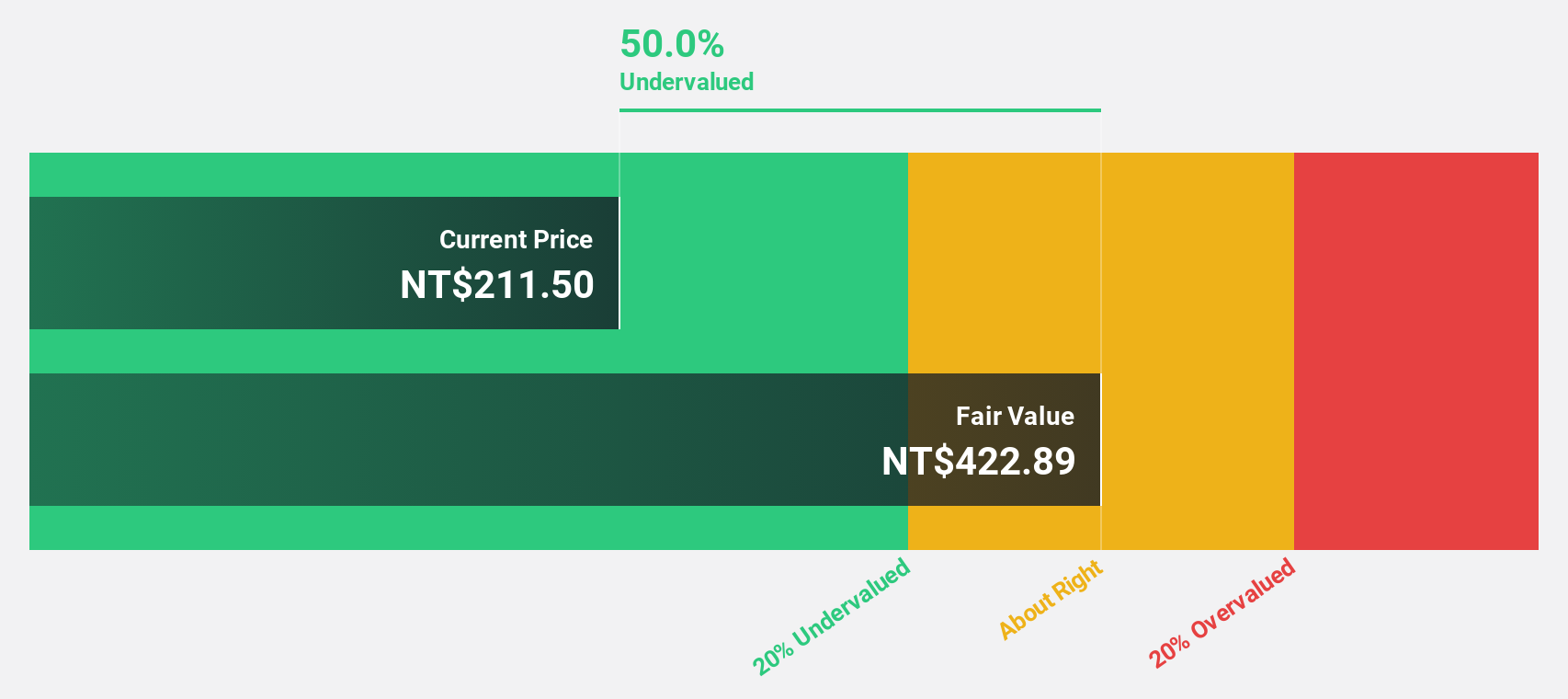

Estimated Discount To Fair Value: 43.9%

Taiwan Union Technology is trading at NT$174.5, well below its estimated fair value of NT$310.79, highlighting potential undervaluation based on cash flows. The company’s earnings are forecast to grow significantly at 23.6% annually, outpacing the Taiwan market’s average growth rate and supported by recent strong performance with net income rising to TWD 754.05 million for Q3 2024 from TWD 369.34 million a year ago, despite non-cash earnings concerns and dividend coverage issues.

Make It Happen

- Access the full spectrum of 897 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Shareholder in one or more of these companies? Ensure you’re never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice.

It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]