As global markets navigate a mixed landscape, with U.S. indices closing out a strong year despite recent volatility and European stocks showing varied performance, investors are keenly observing economic indicators like the Chicago PMI and GDP forecasts for signs of future trends. Amidst these developments, identifying stocks priced below their estimated intrinsic value can offer potential opportunities for those looking to capitalize on market inefficiencies. In this context, understanding the fundamentals that contribute to a stock’s intrinsic value becomes crucial in discerning which investments might be undervalued relative to their true worth.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Avant Group (TSE:3836) | ¥1881.00 | ¥3755.69 | 49.9% |

| NBTM New Materials Group (SHSE:600114) | CN¥15.55 | CN¥31.01 | 49.8% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1120.30 | ₹2231.24 | 49.8% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.725 | €5.45 | 50% |

| Hyundai Rotem (KOSE:A064350) | ₩54300.00 | ₩108421.71 | 49.9% |

| W5 Solutions (OM:W5) | SEK46.85 | SEK93.57 | 49.9% |

| Mr. Cooper Group (NasdaqCM:COOP) | US$93.54 | US$186.41 | 49.8% |

| Exosens (ENXTPA:EXENS) | €22.42 | €44.72 | 49.9% |

| Vogo (ENXTPA:ALVGO) | €2.93 | €5.85 | 49.9% |

| iFLYTEKLTD (SZSE:002230) | CN¥45.41 | CN¥90.62 | 49.9% |

Click here to see the full list of 884 stocks from our Undervalued Stocks Based On Cash Flows screener.

Let’s take a closer look at a couple of our picks from the screened companies.

Overview: Hd Hyundai Mipo Co., Ltd. is a South Korean company that specializes in the manufacturing, repair, and remodeling of ships, with a market cap of ₩5.40 trillion.

Operations: The company’s revenue primarily comes from its shipbuilding segment, totaling ₩5.21 billion, with a connection adjustment of -₩902.96 million.

Estimated Discount To Fair Value: 48.7%

Hd Hyundai Mipo Ltd. is trading at 48.7% below its estimated fair value of ₩271,998.74, highlighting significant undervaluation based on cash flows. Despite a recent net loss in Q3 2024, the company showed improved nine-month results with a net income of ₩29 billion compared to a previous net loss. Revenue is expected to grow at 11.2% per year, outpacing the Korean market average, and profitability is anticipated within three years.

Overview: Appotronics Corporation Limited focuses on the research, development, production, sale, and leasing of laser display devices and machines in China with a market cap of CN¥6.38 billion.

Operations: Appotronics Corporation Limited generates revenue through its involvement in the research, development, production, sale, and leasing of laser display devices and machines within China.

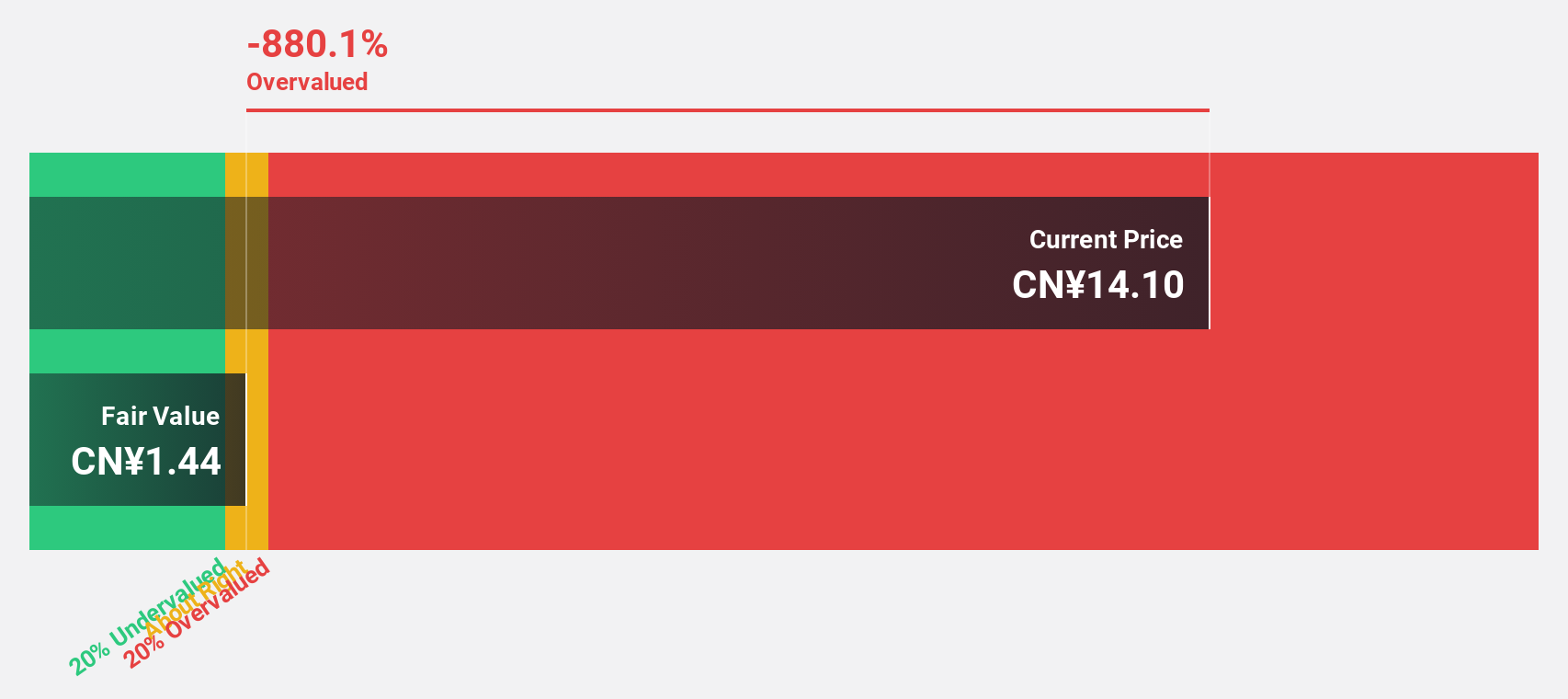

Estimated Discount To Fair Value: 19.8%

Appotronics is trading at a 19.8% discount to its estimated fair value of CN¥17.77, suggesting undervaluation based on cash flows. Despite a decline in net profit margins from 6.8% to 0.8%, earnings are projected to grow significantly at 81% annually, outpacing the Chinese market’s average growth rate of 25.2%. The recent partnership with Ceres Holographics could enhance future revenue streams by leveraging advanced display technologies for automotive applications.

Overview: Xi’an NovaStar Tech Co., Ltd. specializes in providing LED display control solutions in China and has a market capitalization of approximately CN¥15.39 billion.

Operations: The company generates revenue from its Electronic Components & Parts segment, amounting to CN¥3.28 billion.

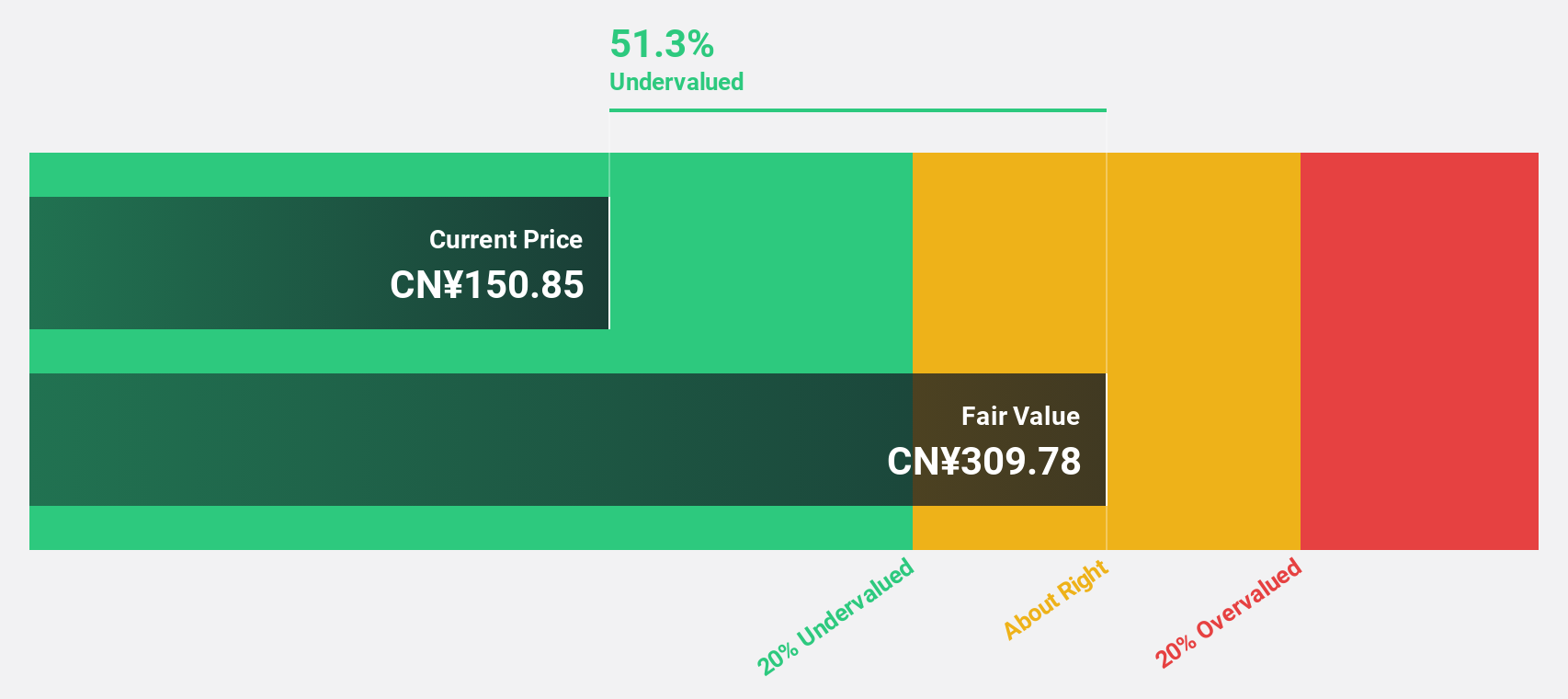

Estimated Discount To Fair Value: 45.4%

Xi’an NovaStar Tech is trading at a significant 45.4% discount to its estimated fair value of CN¥303.55, highlighting potential undervaluation based on cash flows. The company forecasts robust revenue growth of 30.2% annually, outpacing the broader Chinese market’s growth rate of 13.5%. Despite high non-cash earnings affecting dividend sustainability, recent share buybacks worth CN¥85.88 million and inclusion in key stock indices may bolster investor confidence and support long-term value retention strategies.

Where To Now?

Ready To Venture Into Other Investment Styles?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice.

It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]