As global markets navigate mixed signals with U.S. stocks closing out a strong year despite recent slumps, and economic indicators like the Chicago PMI pointing to potential challenges ahead, investors are increasingly on the lookout for opportunities that may be trading below their intrinsic value. In this context, identifying undervalued stocks becomes crucial as they can offer potential growth even amid fluctuating market conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Camden National (NasdaqGS:CAC) | US$42.01 | US$83.84 | 49.9% |

| Brickability Group (AIM:BRCK) | £0.626 | £1.25 | 49.8% |

| Decisive Dividend (TSXV:DE) | CA$6.00 | CA$11.94 | 49.8% |

| Brunel International (ENXTAM:BRNL) | €9.84 | €19.64 | 49.9% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.73 | €5.44 | 49.8% |

| EnomotoLtd (TSE:6928) | ¥1455.00 | ¥2888.47 | 49.6% |

| Zhende Medical (SHSE:603301) | CN¥20.93 | CN¥41.97 | 50.1% |

| ReadyTech Holdings (ASX:RDY) | A$3.19 | A$6.28 | 49.2% |

| Neosperience (BIT:NSP) | €0.572 | €1.14 | 49.8% |

| Vogo (ENXTPA:ALVGO) | €2.92 | €5.81 | 49.8% |

Click here to see the full list of 890 stocks from our Undervalued Stocks Based On Cash Flows screener.

We’ll examine a selection from our screener results.

Overview: Vimian Group AB (publ) operates in the global animal health industry and has a market capitalization of SEK20.82 billion.

Operations: The company’s revenue segments include Medtech (€112.75 million), Diagnostics (€20.32 million), Specialty Pharma (€163.45 million), and Veterinary Services (€56.11 million).

Estimated Discount To Fair Value: 29.4%

Vimian Group appears undervalued, trading at SEK39.8, which is 29.4% below its estimated fair value of SEK56.37. Despite recent shareholder dilution and significant insider selling, earnings are forecast to grow significantly at 89.8% annually over the next three years, outpacing the Swedish market’s growth rate of 14.6%. However, recent financial results showed a net loss in Q3 2024 due to large one-off items impacting earnings quality.

Overview: Ningbo Zhenyu Technology Co., Ltd. is engaged in the research, development, manufacturing, and sale of lamination dies and precision machining equipment both in China and internationally, with a market cap of CN¥7.04 billion.

Operations: The company’s revenue is primarily derived from its Machinery & Industrial Equipment segment, which generated CN¥6.76 billion.

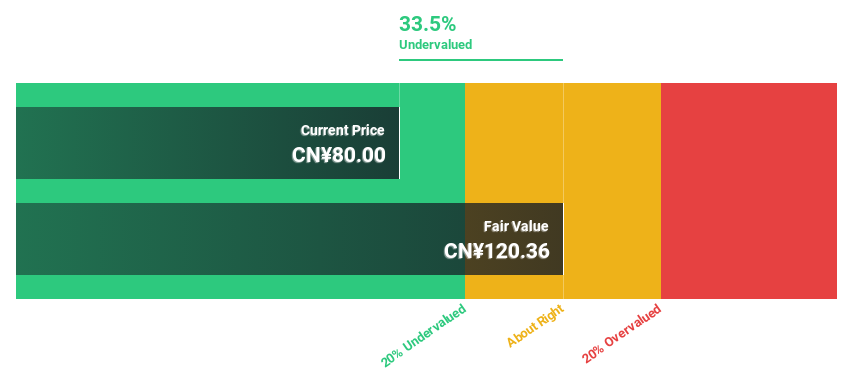

Estimated Discount To Fair Value: 41.9%

Ningbo Zhenyu Technology is trading at CN¥69.75, significantly below its estimated fair value of CN¥119.97, suggesting potential undervaluation based on cash flows. The company’s earnings are projected to grow substantially at 54.2% annually, surpassing the Chinese market’s growth rate of 25.1%. Despite this positive outlook, interest payments are not well covered by earnings, and recent buybacks totaling CN¥119.53 million were completed without further share repurchases planned.

Overview: Global Security Experts Inc. is a cybersecurity education company based in Japan with a market cap of ¥39.57 billion.

Operations: Global Security Experts Inc. generates revenue through its cybersecurity education services in Japan.

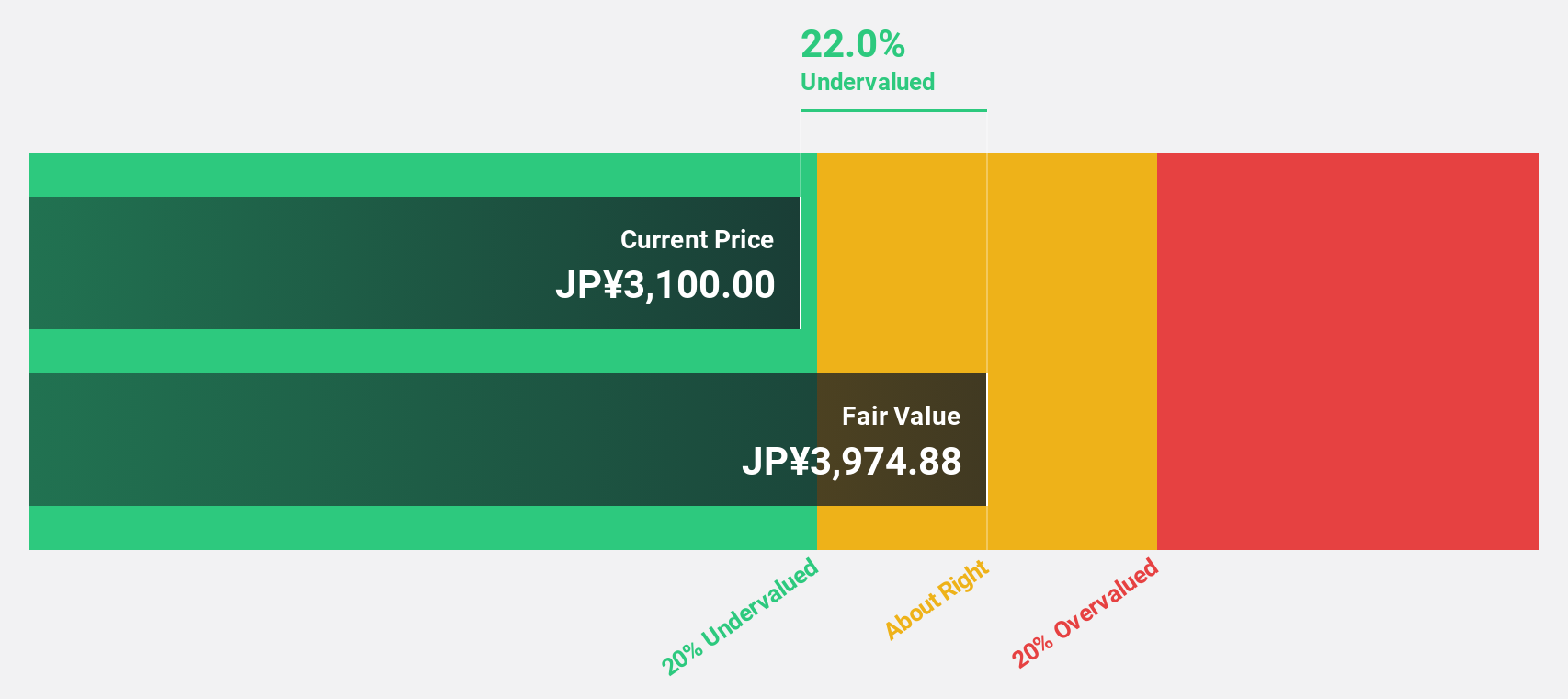

Estimated Discount To Fair Value: 39.8%

Global Security Experts is trading at ¥5,270, well below its estimated fair value of ¥8,750.52, highlighting potential undervaluation based on cash flows. Earnings are expected to grow significantly at 26.3% annually, outpacing the Japanese market’s growth rate of 7.9%. Despite high debt levels and recent share price volatility, the company’s return on equity is forecasted to be very high in three years at 42.4%, supporting a strong financial outlook.

Key Takeaways

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice.

It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]