As we enter January 2025, global markets are reflecting a mixed performance with the U.S. indices closing out a strong year despite recent fluctuations, while economic indicators like the Chicago PMI highlight ongoing challenges in manufacturing. Amidst these dynamics, identifying undervalued stocks can be crucial for investors looking to capitalize on potential opportunities within sectors that may benefit from current market conditions and economic trends.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Avant Group (TSE:3836) | ¥1878.00 | ¥3755.66 | 50% |

| NBTM New Materials Group (SHSE:600114) | CN¥15.55 | CN¥31.07 | 49.9% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.9% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1120.30 | ₹2232.36 | 49.8% |

| Kinaxis (TSX:KXS) | CA$170.99 | CA$340.11 | 49.7% |

| ReadyTech Holdings (ASX:RDY) | A$3.15 | A$6.30 | 50% |

| Vogo (ENXTPA:ALVGO) | €2.94 | €5.87 | 49.9% |

| Exosens (ENXTPA:EXENS) | €22.505 | €44.77 | 49.7% |

| iFLYTEKLTD (SZSE:002230) | CN¥45.41 | CN¥90.65 | 49.9% |

| Salmones Camanchaca (SNSE:SALMOCAM) | CLP2434.90 | CLP4848.26 | 49.8% |

Click here to see the full list of 885 stocks from our Undervalued Stocks Based On Cash Flows screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Overview: Mao Geping Cosmetics Co., Ltd. operates in China, offering color cosmetics and skincare products under the MAOGEPING and Love Keeps brands, with a market cap of HK$27.82 billion.

Operations: The company generates CN¥3.46 billion in revenue from its personal products segment.

Estimated Discount To Fair Value: 29.2%

Mao Geping Cosmetics is trading at HK$58.15, below its estimated fair value of HK$82.13, suggesting undervaluation based on cash flows. The company recently completed an IPO worth HK$2.34 billion, enhancing its financial position. Earnings grew by 59.2% last year and are expected to grow significantly at 24.3% annually over the next three years, outpacing the Hong Kong market’s growth rate of 11.1%, despite shares being highly illiquid.

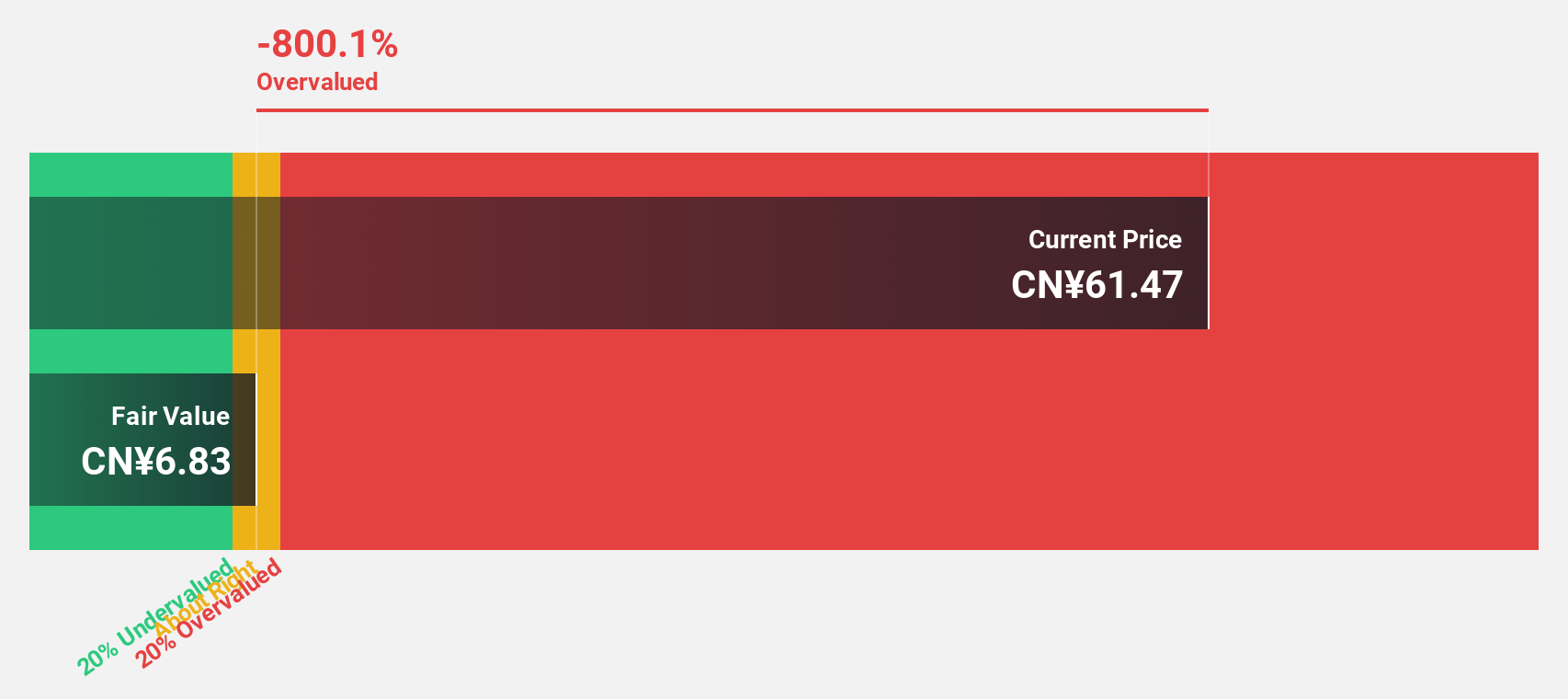

Overview: SolaX Power Network Technology (Zhejiang) Co., Ltd. (ticker: SHSE:688717) operates in the renewable energy sector, focusing on the development and manufacturing of solar power products, with a market cap of CN¥7.64 billion.

Operations: The company’s revenue is primarily derived from its Electronic Components & Parts segment, totaling CN¥2.87 billion.

Estimated Discount To Fair Value: 23.9%

SolaX Power Network Technology (Zhejiang) is trading at CN¥47.73, below its estimated fair value of CN¥62.74, indicating potential undervaluation based on cash flows. Despite a decline in net income and profit margins compared to the previous year, earnings are projected to grow significantly at 55% annually over the next three years. Revenue growth is also expected to outpace the broader Chinese market, although return on equity forecasts remain modest at 12.1%.

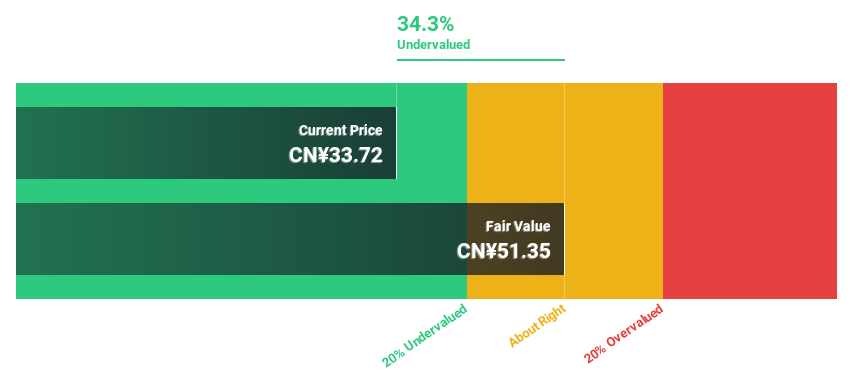

Overview: Zhejiang Songyuan Automotive Safety Systems Co., Ltd. operates in the automotive safety industry, focusing on the production and sale of safety systems, with a market cap of CN¥6.76 billion.

Operations: The company generates revenue of CN¥1.78 billion from its Auto Parts & Accessories segment.

Estimated Discount To Fair Value: 20%

Zhejiang Songyuan Automotive Safety Systems is trading at CN¥29.86, significantly below its estimated fair value of CN¥37.34, highlighting potential undervaluation based on cash flows. The company reported strong earnings growth with net income rising to CNY 190.71 million for the first nine months of 2024. Despite high debt levels and a dividend not well covered by free cash flows, revenue and earnings are forecasted to grow substantially above market rates in the coming years.

Make It Happen

Looking For Alternative Opportunities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice.

It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]