Insider Brief

- The quantum industry’s stock market turbulence this week revealed the critical role of investor expectations around the timing of future cash flow generation.

- Discounted Cash Flow analysis shows that even slight delays in expected cash flow timelines can cause drastic valuation swings for quantum companies compared to mature firms.

- Public sentiment seems divided, with some believing “very useful” quantum computers are less than 10 years away, contrasting with NVIDIA CEO Jensen Huang’s claim of a 20-year timeline.

The quantum industry had a rude lesson in stock market turbulence, and an even more stark reminder of how investor sentiment is shaped by the timing of future cash flow expectations.

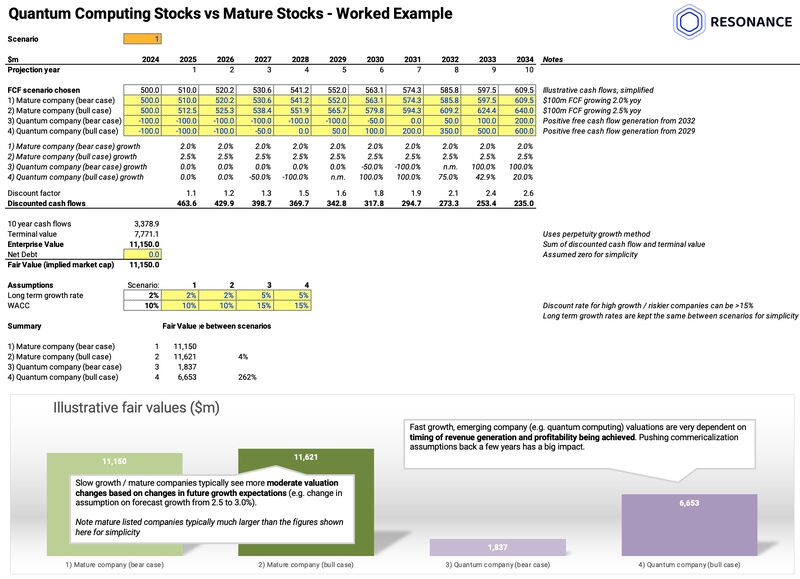

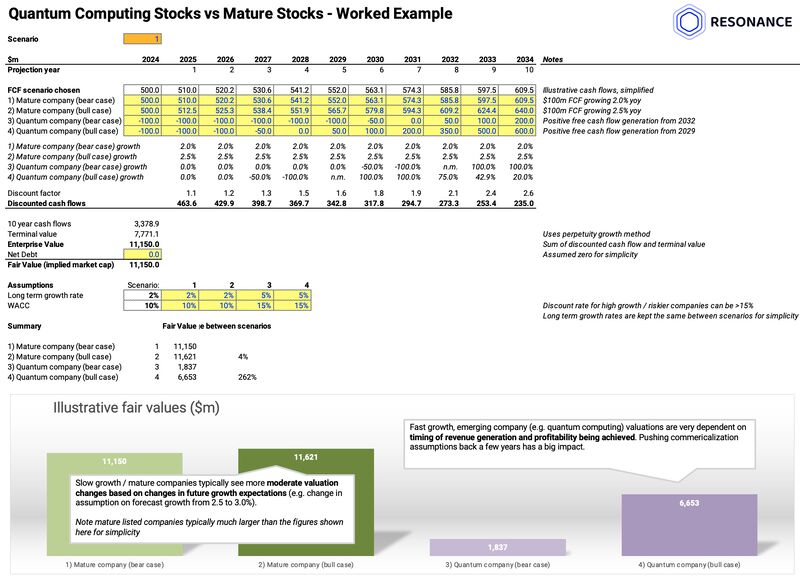

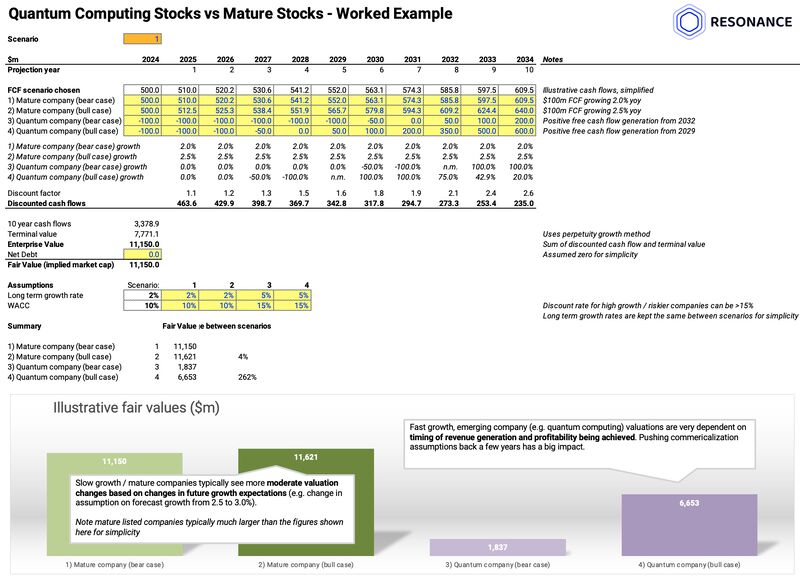

To explore this even deeper, the Resonance team put together a new worked example that underscores the financial mechanics driving this volatility.

Stock prices reflect market expectations about a company’s growth trajectory. For established companies, valuation changes are often incremental, tied to modest revisions in growth forecasts due to factors like sales performance or product delays.

Quantum computing companies, however, operate on an entirely different dynamic. While some have started generating revenue, their valuations are largely driven by future potential—specifically, when significant cash flow generation will materialize. This makes their stock prices far more sensitive to shifts in investor timelines.

A Discounted Cash Flow (DCF) analysis demonstrates the impact of these shifting expectations. In their example, they model fair valuations for four scenarios: mature companies (bear and bull cases) and quantum computing companies (bear and bull cases). The projections highlight how even a three-year delay in expected cash flow generation for quantum companies can lead to drastic valuation swings.

In the mature company bear case, stable growth assumptions (2% annual growth) lead to a fair value of $11.150 billion. By contrast, in the quantum company bear case, delayed cash flow generation pushes the fair value to just $1.837 billion. This stark drop reflects the heightened risk investors associate with long-term, unproven business models. The quantum company bull case shows a significantly higher valuation of $6.653 billion, emphasizing the critical role of timing and growth assumptions.

Resonance’s analysis also reveals that quantum computing valuations are more dependent on commercialization timelines than changes in the increases of projected revenue, also known as growth rate adjustments. A fast-growth, emerging company like those in quantum computing can see its valuation shift dramatically with small changes in cash flow timing, unlike mature firms with steadier, proven revenue streams.

This week’s market reactions to a single commentator offer a good example of this sensitivity. Comments from NVIDIA CEO Jensen Huang about quantum computers being “20 years away” contributed to a rapid and sharp decline in stock prices across the sector. While the accuracy of Huang’s remarks remains debatable, Resonance’s findings suggest that such statements, coupled with investor uncertainty, can exacerbate volatility in this nascent industry.

We’ve also detected a divergence in public sentiment that might signal a call for some optimism, or at least a call against abject pessimism. Although not designed to deliver scientifically valid results, a recent LinkedIn and X survey on The Quantum Insider revealed that most respondents believe “very useful” quantum computers could arrive in less than 10 years, challenging the timeline proposed by Huang.

However, these conflicting perceptions, driven by the speculative nature of quantum computing investments may be a regular feature for investors as quantum companies strive to give better evidence of their commercialization trajectory.