As global markets navigate a complex landscape marked by interest rate cuts from the ECB and SNB, alongside anticipation of further easing by the Federal Reserve, investors are witnessing mixed performances across major indices. While technology stocks continue to drive gains in the Nasdaq Composite, broader market volatility presents opportunities for discerning investors to identify stocks trading below their intrinsic value. In such an environment, a good stock is often characterized by strong fundamentals that may not yet be fully recognized by the market, offering potential for long-term appreciation despite current economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | US$26.67 | US$53.13 | 49.8% |

| Shenzhen King Explorer Science and Technology (SZSE:002917) | CN¥9.59 | CN¥19.09 | 49.8% |

| technotrans (XTRA:TTR1) | €15.40 | €30.59 | 49.7% |

| Xiamen Bank (SHSE:601187) | CN¥5.70 | CN¥11.35 | 49.8% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.8% |

| Hanwha Systems (KOSE:A272210) | ₩20900.00 | ₩41661.29 | 49.8% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP291.30 | CLP579.37 | 49.7% |

| Constellium (NYSE:CSTM) | US$10.91 | US$21.69 | 49.7% |

| ReadyTech Holdings (ASX:RDY) | A$3.15 | A$6.28 | 49.9% |

| FINEOS Corporation Holdings (ASX:FCL) | A$1.91 | A$3.82 | 49.9% |

Click here to see the full list of 875 stocks from our Undervalued Stocks Based On Cash Flows screener.

Let’s take a closer look at a couple of our picks from the screened companies.

Overview: Xiaomi Corporation is an investment holding company that offers hardware and software services both in Mainland China and internationally, with a market cap of approximately HK$746.54 billion.

Operations: Xiaomi generates its revenue through various segments, including hardware and software services, catering to both the Mainland China market and international markets.

Estimated Discount To Fair Value: 15.7%

Xiaomi’s recent earnings report highlights robust financial performance, with Q3 2024 sales reaching CNY 92.51 billion and net income at CNY 5.35 billion, both showing year-over-year growth. The stock is trading at HK$30.8, below its estimated fair value of HK$36.56, suggesting it may be undervalued based on discounted cash flow analysis. While revenue growth is forecasted to outpace the Hong Kong market, return on equity remains modest at a projected 15.6%.

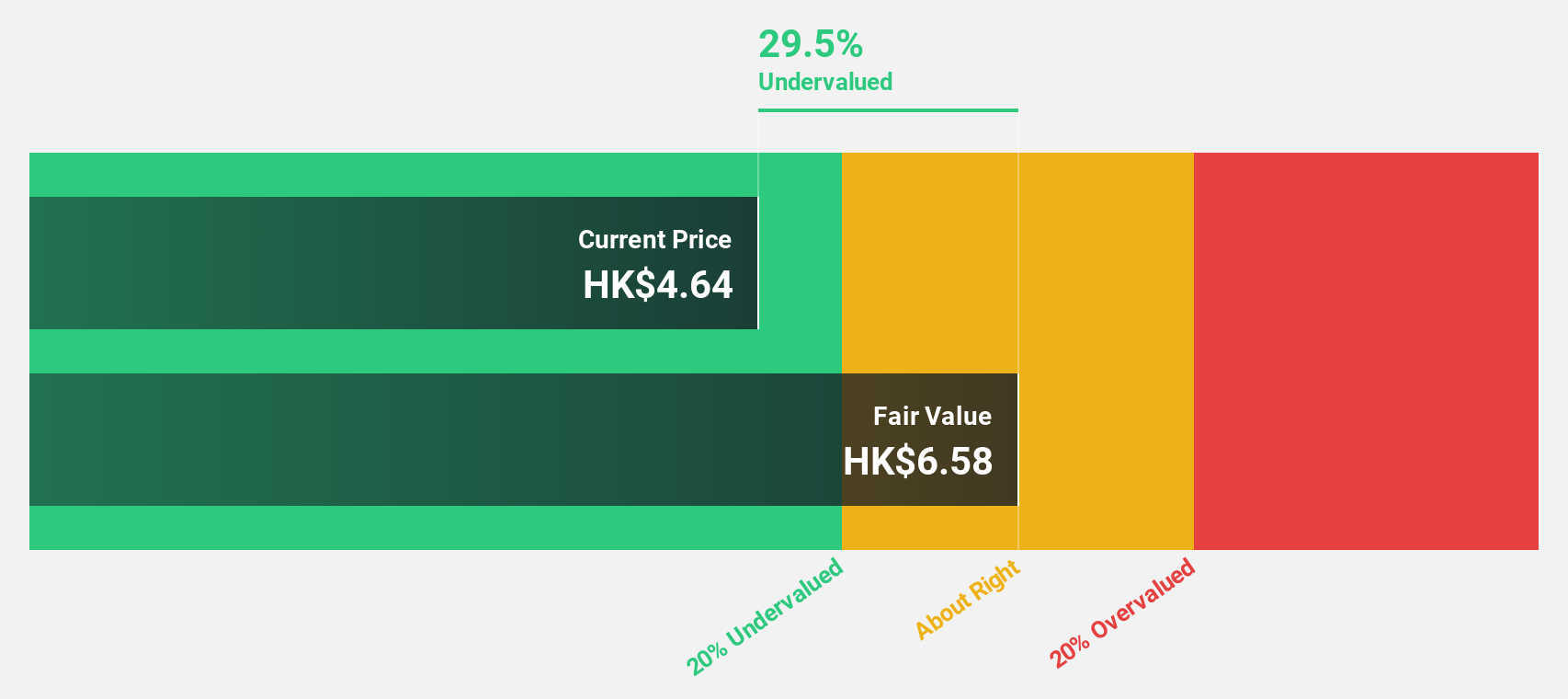

Overview: Wasion Holdings Limited is an investment holding company that focuses on the research, development, production, and sale of energy metering and energy efficiency management solutions for energy supply industries across various regions, with a market capitalization of approximately HK$6.73 billion.

Operations: The company’s revenue segments include Advanced Distribution Operations (CN¥2.51 billion), Power Advanced Metering Infrastructure (CN¥2.99 billion), and Communication and Fluid Advanced Metering Infrastructure (CN¥2.42 billion).

Estimated Discount To Fair Value: 48.8%

Wasion Holdings is trading at HK$7.14, significantly below its estimated fair value of HK$13.94, indicating potential undervaluation based on discounted cash flow analysis. The company’s earnings are forecast to grow substantially at 22.8% annually, outpacing the Hong Kong market’s growth rate of 11.6%. Although the return on equity is projected to be modest at 15.5% in three years, recent earnings growth was robust at 61.9%, highlighting strong financial performance despite an unstable dividend track record.

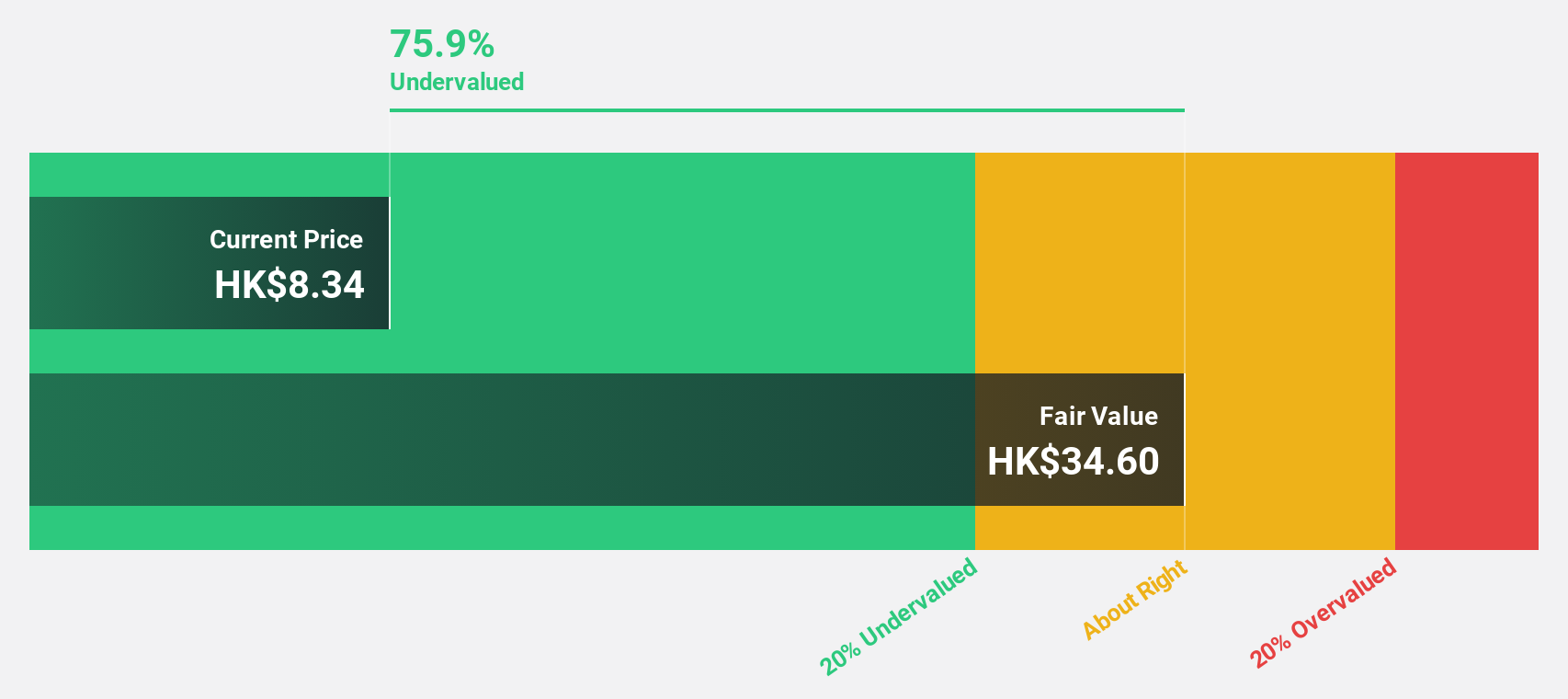

Overview: Bosideng International Holdings Limited operates in the apparel industry within the People’s Republic of China, with a market capitalization of approximately HK$43.72 billion.

Operations: The company’s revenue segments include Down Apparels at CN¥20.66 billion, Ladieswear Apparels at CN¥735.22 million, Diversified Apparels at CN¥254.12 million, and Original Equipment Manufacturing (OEM) Management at CN¥2.97 billion.

Estimated Discount To Fair Value: 26.6%

Bosideng International Holdings is trading at HK$4.09, below its estimated fair value of HK$5.57, suggesting undervaluation based on discounted cash flow analysis. Revenue growth is expected to outpace the Hong Kong market at 11.5% annually, with earnings projected to grow 12.9% per year, supported by recent financial results showing increased sales and net income for the first half of 2024. However, the dividend track record remains unstable despite a recent interim dividend announcement.

Taking Advantage

- Navigate through the entire inventory of 875 Undervalued Stocks Based On Cash Flows here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice.

It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Explore Now for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]