Hd Hyundai Mipo Co.,Ltd. (KRX:010620) Shares Could Be 43% Below Their Intrinsic Value Estimate

Key Insights Hd Hyundai MipoLtd’s estimated fair value is ₩234,046 based on 2 Stage Free Cash Flow to Equity Hd Hyundai MipoLtd is estimated to be 43% undervalued based on current share price of ₩134,200 Our fair value estimate is…

Is freee K.K. (TSE:4478) Trading At A 45% Discount?

Key Insights Using the 2 Stage Free Cash Flow to Equity, freee K.K fair value estimate is JP¥5,503 freee K.K is estimated to be 45% undervalued based on current share price of JP¥3,035 Our fair value estimate is 91% higher…

Lupin Reports 6.7% Net Profit Growth, Achieves Highest Operating Cash Flow of Rs 3,648.36 Crore

Lupin has received a ‘Buy’ rating from MarketsMojo as of December 30, 2024, due to its strong financial health, evidenced by a low Debt to EBITDA ratio of 1.27. The company reported a 6.7% net profit growth for September 2024,…

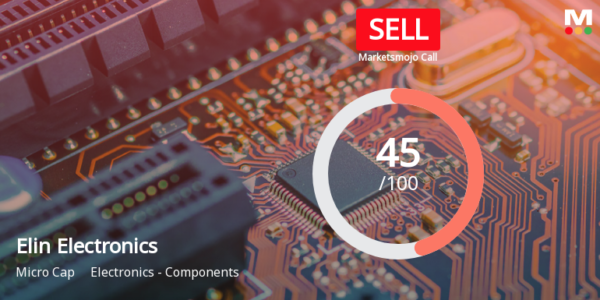

Elin Electronics Stock Downgraded to ‘Sell’ Amid Declining Operating Profit and Cash Flow

Elin Electronics has been downgraded to ‘Sell’ by MarketsMojo due to concerns over long-term growth, with a 1.66% decline in annual operating profit over five years. The company reported flat financial results for September 2024, with low operating cash flow…

3 US Stocks Estimated To Be Trading At Up To 48.2% Below Intrinsic Value

With major U.S. stock indexes poised to open lower, reflecting a continuation of recent declines, investors are increasingly seeking opportunities amidst market volatility. In this environment, identifying undervalued stocks becomes crucial, as these can potentially offer significant value relative to…

3 Stocks That May Be Trading Below Estimated Value In December 2024

As global markets navigate a mixed economic landscape, with U.S. consumer confidence dipping and major indices experiencing both gains and losses during the holiday-shortened week, investors are keenly observing potential opportunities in undervalued stocks. In such a climate, identifying stocks…

Uncovering American Express Co’s Intrinsic Value

In this article, we will take a look into American Express Co’s (NYSE:AXP) DCF analysis, a reliable and data-driven approach to estimating its intrinsic value. Instead of using future free cash flow as in the traditional DCF model, the GuruFocus…

Will Legacy Tech or Instant Payments Win 2025 Cash Flow Race?

A quarter-century into the new millennia, the banking and payments industries have witnessed a rapid pace of change. Consumers and businesses demand faster, more efficient transaction methods, pushing financial institutions to prioritize real-time capabilities. “We launched the RTP® network about…

December 2024’s Top Stock Selections Estimably Priced Below Fair Value

As global markets navigate a complex landscape marked by fluctuating consumer confidence and shifting economic indicators, major indices like the Nasdaq Composite and S&P 500 have shown mixed performance in recent weeks. Amidst this backdrop, identifying stocks that are potentially…

A Look At The Fair Value Of Fortnox AB (publ) (STO:FNOX)

Key Insights The projected fair value for Fortnox is kr77.12 based on 2 Stage Free Cash Flow to Equity With kr72.98 share price, Fortnox appears to be trading close to its estimated fair value Analyst price target for FNOX is…